Members

Everything you need to know about tax-free shopping

What is the VAT refund process? Are you eligible for it? How do you get your VAT refund? ZappTax can help you with the answers to all these questions.

Anyone whose main residence is outside the European Union has the right to a VAT refund. Buyers can request a VAT refund on any purchase made in the EU and taken home, in their luggage, to their country of residence.

Surprisingly few people are aware of this profitable option – so ZappTax has produced this straightforward explanation of how VAT refunds work.

VAT refund: Official definition and legislation explained

The French Directorate General of Customs and Indirect Taxes (DGDDI) officially defines VAT refunds thus:

“The traveller whose domicile or habitual residence is not in France or another Member State of the European Union can buy goods for export exempted from paying the value added tax (VAT) or benefit from a refund of this VAT.”

Note that this definition is essentially the same across all member states of the European Union.

So why, as a non-EU resident, do you not have to pay VAT?

Legal explanation by the European Commission

The legal basis for VAT refunds can be understood if you look at how VAT works.

On its website, the European Commission states that “in the European Union, value added tax, or VAT, “[...] more or less applies to all goods and services bought and sold in order to be used or consumed in the European Union. Thus, goods sold for export [...] outside the EU are normally not subjected to VAT.”

Thus goods purchased in the EU but then taken with you for consumption or use in your country of residence outside the EU are not subjected to VAT.

If a vendor sells products VAT-free to non-EU residents, there is no guarantee that these products will actually leave the EU. The regulations therefore provide for the exemption to be applied in the form of a VAT refund after the buyer leaves the EU, since carrying the purchase in your luggage is “proof” of export.

since carrying the purchase in your luggage is “proof” of export.

What qualifies you for a VAT refund?

In order to claim a VAT refund on your purchases, certain conditions must be satisfied.

1. You must reside outside the European Union

You can claim a VAT refund only if you live in a non-EU country (this is independent of nationality). A French expatriate in the UK will therefore be eligible for a VAT refund, but an American residing in Italy will not. A person of Chinese nationality residing in Paris is also ineligible for a VAT refund when travelling outside the EU.

2. Each country sets a minimum purchase threshold to claim VAT refund

While VAT refunds are allowed across the European Union, each member state is free to set a minimum purchase amount for claiming a VAT refund. Depending on how the VAT refund on your purchases is obtained (see below), this threshold is applicable per store and per day (which is very restrictive) OR on all purchases made during your stay.

3. You must leave the EU before the end of the third month following the month of purchase

Most countries will only refund VAT if you leave the EU with your purchased goods and obtain customs validation of your tax-free form no later than the last day of the third month following the month of your purchase. Note that some countries, such as France, require that your stay in the EU be shorter than six months.

4. You must leave the EU with all the goods on which you want to claim the VAT refund

In order to get your VAT refund, you must take purchased goods out of the EU with you. If these goods remain in the EU, you cannot claim a VAT refund on them. Note that these goods must be unused and in their original packaging when they leave the EU.

How can you shop tax-free in the EU?

There are two ways to shop tax-free:

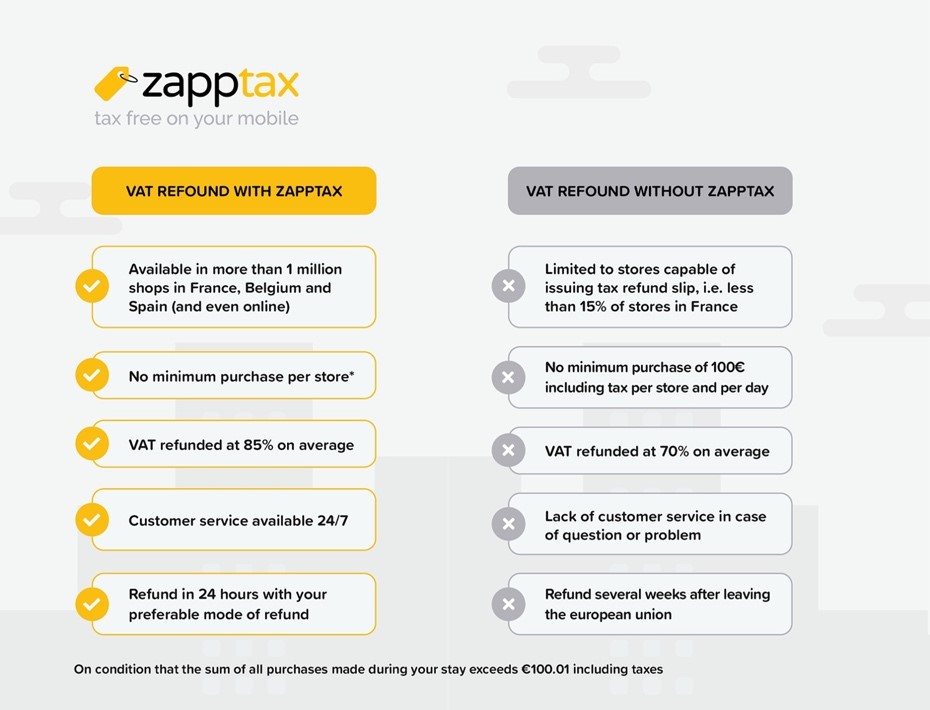

- The traditional system is to have VAT refund provided by the vendor, most often in collaboration with an intermediary called a “tax-refund operator”. Since shop owners are not obliged to offer VAT refunds, most of them do not.

- The ZappTax system, which simplifies the VAT refund process, can be used when shopping in any store in France, Belgium, or Spain.

Whatever system you choose, there are some important steps that you will need to follow before, during, and after your purchase if you want to claim a VAT refund. Should you need more information, please consult www.zapptax.com

ZappTax is a mobile application that makes it easier for international travellers living outside the European Union to get a refund of the value added tax (VAT) paid on goods they purchase while travelling abroad. The application allows you to shop tax-free anywhere – even online – with no minimum purchase threshold and with fast refunds at good rates.